does oklahoma have an estate or inheritance tax

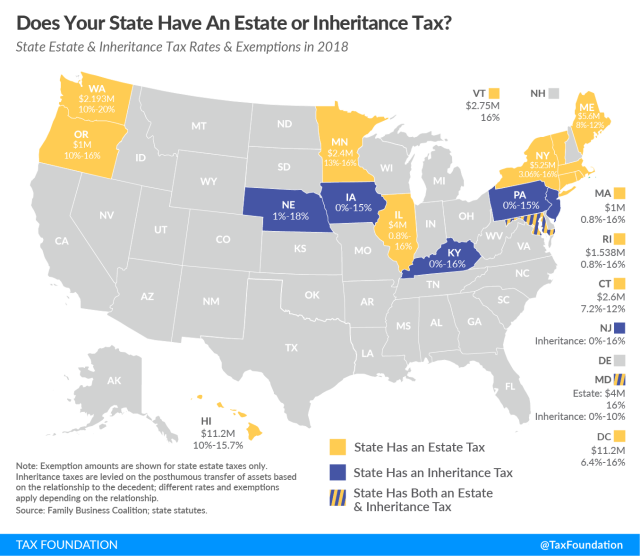

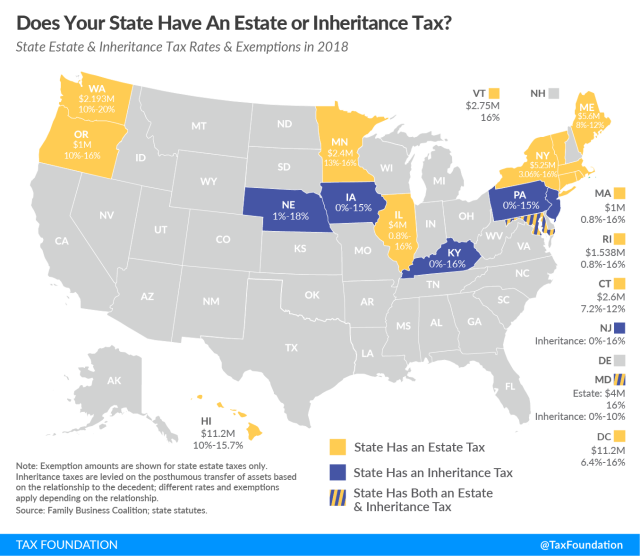

Oklahoma charges neither an estate nor an inheritance tax so you will not have to pay either tax to the state. Iowa Kentucky Nebraska New Jersey and Pennsylvania are the states that do have the local inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Lets cut right to the chase.

. However California residents are subject to federal laws governing gifts during their lives and their estates after they die. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma.

If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real estate located in Oklahoma you will not have to pay an inheritance tax. Even though Oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

Here S Which States Collect Zero Estate Or Inheritance Taxes Oklahoma Estate Tax Everything You Need To Know Smartasset Calculating Inheritance Tax Laws Com Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys State Estate And Inheritance Taxes Itep Do I Need To Pay Inheritance Taxes Postic Bates P C. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million.

Seven states have repealed their estate taxes since 2010. In 2021 this amount was 15000 and in 2022 this. Prior to that Arkansas charged a pick-up or sponge tax that equaled a portion of an estates federal estate tax bill but that has not been the case over the last 14 years.

California does not have an inheritance tax estate tax or gift tax. Estate taxes and inheritance taxes. States With No Estate Tax Or Inheritance Tax Plan Where You Die While each state sets its own laws regarding inheritance taxes the majority of US.

Find out if Oklahoma collects either or both taxes on the estate after someone has died. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. Each California resident may gift a certain amount of property in a given tax year tax-free.

Why you should still plan for death taxes The fact that. In some cases however there are still taxes that can be placed on a persons estate. Those who handle your estate following your death though do have some other tax returns to take care of such as.

States including Kansas do not have estate or inheritance taxes in place as of 2013. The inheritance tax is no longer imposed after December 31 2015. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million.

Only a few states collect their own estate or inheritance tax. Since January 1 2005 Arkansas has not collected a state-level estate or inheritance tax. Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Estate taxes and inheritance taxes differ because estate taxes are paid by the estate and do not depend on who inherits the assets.

A New Tax Study Should Freak Out Billionaires

Calculating Inheritance Tax Laws Com

Do I Need To Pay Inheritance Taxes Postic Bates P C

Oklahoma Estate Tax Everything You Need To Know Smartasset

Oklahoma Estate Tax Everything You Need To Know Smartasset

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

Oklahoma Estate Tax Everything You Need To Know Smartasset

Here S Which States Collect Zero Estate Or Inheritance Taxes

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes Itep

Is There A Federal Inheritance Tax Legalzoom Com

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Do I Need To Pay Inheritance Taxes Postic Bates P C

Inheritance Tax How It Works How Much It Is Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die